Did you know that General Motors (GM) has been a major player in the automotive industry for over a century, with a market capitalization that fluctuates between $50 and $80 billion? Despite the global shift towards electric vehicles and the challenges posed by recent economic uncertainties, GM remains a significant force on Wall Street.

The company’s stock performance offers insights into both the automotive industry and the broader financial market. In this article, we’ll explore the current state of GM’s stock, its recent performance, and what you need to know as an investor.

What is GM?

General Motors (GM) is one of the largest automakers in the world, known for producing vehicles under brands like Chevrolet, GMC, Cadillac, and Buick. Founded in 1908, GM is headquartered in Detroit, Michigan, and operates in over 120 countries. They produce cars, trucks, and electric vehicles, with a focus on innovation and sustainability.

GM is a key player in the electric vehicle market, aiming to have 30 EV models by 2025. With nearly 167,000 employees worldwide, GM continues to drive advancements in automotive technology, including autonomous vehicles and battery innovation.

Overview of FintechZoom GM Stock Analysis 2024

General Motors (GM) stock analysis for 2024 shows promising growth potential. GM’s focus on electric vehicles (EVs) and autonomous driving technologies has boosted investor confidence, leading to an 18.15% increase in stock value this year. A

nalysts predict a potential 18.45% rise, with price targets ranging between $28 and $95, averaging around $50.27. GM’s strategic investments and strong financial performance, including a favorable price-to-earnings ratio, make it attractive to value investors. However, risks like competition and supply chain challenges remain factors to consider.

Factors Influencing GM Stock in 2024

When investing in General Motors (GM) stock, several key factors will play a big role in 2024. Let’s break them down in simple terms, focusing on what really matters for both new and experienced investors.

1. Company Developments

GM’s performance is closely tied to its innovations and business decisions. In 2024, keep an eye on electric vehicle (EV) advancements and autonomous driving technology. The launch of new models, partnerships, and financial earnings reports will shape the stock price. For example, GM’s 2023 $35 billion investment in EVs will likely pay off, making it crucial to follow.

2. Economic Factors

Global economic conditions heavily influence GM’s stock. A strong economy boosts car sales, while a recession can slow them down. Inflation rates, consumer spending, and interest rates will all impact GM’s revenue in 2024. If borrowing costs rise, it could hurt vehicle financing, affecting overall sales. In 2023, GM’s sales rebounded due to economic recovery, making it a factor to watch.

3. Regulatory Environment

Changes in environmental regulations or trade policies can impact GM’s stock. Stricter emissions standards or tariffs may increase production costs. In 2024, U.S. government policies promoting EVs through tax incentives could benefit GM, pushing its stock upward. Regulatory shifts in China, one of GM’s largest markets, will also play a key role.

4. Industry Trends

The car industry is changing quickly, and electric vehicles are at the forefront. In 2024, the global EV market is expected to grow by 25%. GM’s push into this space is critical for future success. Additionally, consumer preferences for sustainability, safety features, and smart technologies will influence demand for GM’s offerings, thereby impacting its stock performance.

5. Supply Chain Stability

Global supply chain disruptions, like the semiconductor shortage seen in 2021 and 2022, can affect GM’s production capacity. In 2024, the company’s ability to secure critical parts and materials will be a determining factor in meeting demand. If GM manages to stabilize its supply chain, it will positively influence stock prices.

6. Competitor Actions

GM doesn’t operate in a vacuum, and its competition—especially from companies like Tesla, Ford, and emerging EV makers—will influence its stock in 2024. If competitors launch more appealing products or reduce prices, GM may need to adjust its strategies, which could affect investor confidence and the stock value. Keeping an eye on competitor innovations is key.

Investment Strategies for GM Stock

When investing in GM stock, there are several strategies you can use to balance risk and reward. Let me break down each strategy in simple terms:

1. Effective Risk Management

To manage risk, I always limit how much of my portfolio is in a single stock. For GM, I recommend not exceeding 10-15%. This way, if GM’s stock dips, it doesn’t drastically affect your overall investment. Always set stop-loss limits to protect yourself from major downturns.

2. Balanced Approach

It’s important to balance between growth and stability. GM has a solid history and is strong in the electric vehicle (EV) market, which offers growth potential. At the same time, they offer dividends, giving a balance between long-term growth and regular income.

3. Portfolio Diversification

I never put all my money into one investment. Along with GM, I invest in other industries such as tech or healthcare. Diversifying means that if GM faces industry-specific challenges, my other investments can balance things out, minimizing risk.

4. Long-Term Holding

I’ve found success by holding GM stock long-term. GM is investing heavily in EV technology, which positions them well for the future. This strategy allows me to benefit from potential growth as they transition into a more eco-friendly company over the years.

5. Monitoring Market Trends

Keeping an eye on automotive trends and news can give you a better idea of when to buy or sell. GM’s future is tied to electric vehicles, so I stay updated on their progress in this area, which can signal future stock performance.

Analyst Predictions for GM Stock

Analyst predictions for GM stock in 2024 show a mix of optimism and caution. The 12-month price target ranges between $27 to $95, with an average estimate of around $49.87. Some experts, like those from Citigroup, are very bullish, raising their price target to $95, while others, like Wells Fargo, have a lower estimate of $28. This wide range reflects the uncertainty surrounding GM’s future growth, driven by market conditions and its ventures into electric vehicles.

Risks and Challenges Associated with GM Stock

When evaluating the risks and challenges associated with GM stock, it’s essential to consider a variety of factors that could impact its performance. Let’s break these down in a way that’s easy to understand:

1. Supply Chain Disruptions

Supply chain disruptions have hit the auto industry hard, and GM is no exception. From shortages in critical components like semiconductors to delays in raw materials, GM’s production lines can face unexpected halts. In 2021, GM reported a loss of $2 billion due to these disruptions. Such issues can delay vehicle deliveries and impact profitability, making stock performance unpredictable.

2. Regulatory Uncertainties

Regulatory environments vary globally, and GM faces a complex web of compliance. With rising emissions standards and environmental regulations, especially in key markets like the U.S. and Europe, GM must invest heavily to meet these requirements. Any regulatory changes can lead to increased costs, potential fines, or product recalls, posing a risk to the company’s earnings and stock price.

3. Industry Competition

The automotive sector is fiercely competitive, and GM has to contend with both legacy manufacturers and new players, especially in the electric vehicle (EV) space. Companies like Tesla and Rivian are setting the pace in EV innovation. If GM cannot keep up, it risks losing market share. In 2023, GM’s EV market share was only about 10%, which reflects the pressure they face to compete.

4. Geopolitical Uncertainties

Geopolitical tensions, such as the U.S.-China trade war, can severely impact GM’s operations. GM has significant exposure in China, its largest market outside the U.S. Tariffs or sanctions could affect their ability to manufacture and sell cars. In 2022, GM’s China sales dipped by 8%, highlighting how political factors can directly impact revenue and stock performance.

5. Technological Shifts

The auto industry is rapidly shifting towards electric and autonomous vehicles, and GM must innovate to stay relevant. While GM is investing billions into its EV lineup, any delays or failures in rolling out new technology could hurt its competitiveness. For instance, the success of GM’s electric vehicle push is crucial, but the cost of these investments can weigh down profits in the short term.

6. Economic Downturns

General Motors is highly sensitive to broader economic trends. During economic downturns, consumers tend to delay purchasing vehicles, which directly impacts GM’s sales. For example, during the 2008 financial crisis, GM declared bankruptcy. While they’ve since recovered, any future economic recessions or slowdowns can similarly threaten the company’s earnings and its stock’s stability.

Opportunities for Growth in GM Stock

Here are the 5 opportunities for growth in GM Stock.

1. Sustainability

General Motors (GM) is committed to sustainability by advancing electric vehicles (EVs) and reducing carbon emissions. GM has pledged to be carbon neutral by 2040, with plans to offer 30 electric models by 2025. With government policies pushing for greener solutions, GM’s focus on EVs positions it as a leader in sustainable transportation. Investing now could mean capitalizing on this shift toward cleaner energy solutions.

2. Innovation

GM’s innovation in autonomous driving technology offers substantial growth potential. The company’s Cruise division is a key player in self-driving cars, and GM has invested billions to develop this technology. As autonomous vehicles become more widespread, GM’s cutting-edge advancements may give it an edge in the growing autonomous vehicle market, presenting lucrative long-term opportunities for investors.

3. Industry Competition

While GM faces competition from companies like Tesla, competition often sparks innovation. GM’s established brand and strong infrastructure, combined with its investments in EVs and autonomous technology, position it to compete effectively in the evolving automotive landscape. Staying competitive could attract new customers and investors alike, potentially driving stock growth in the coming years.

4. Market Expansion

GM’s growth opportunities also lie in expanding into emerging markets like China and India, where demand for vehicles is increasing. By targeting these regions with affordable, sustainable vehicles, GM can tap into new customer bases. Market expansion outside of the U.S. could diversify revenue streams and reduce dependency on traditional markets, offering significant long-term potential for investors.

5. Digital Transformation

GM’s focus on digitalization and software integration, such as connected vehicle services, presents new avenues for revenue. The company is enhancing vehicle connectivity through OnStar and other digital platforms, which could provide recurring subscription-based income. As more cars become integrated with digital technology, GM is well-positioned to capitalize on this shift, offering new opportunities for growth.

6. Supply Chain Resilience

In response to recent global supply chain challenges, GM is building a more resilient and flexible supply chain. By securing long-term partnerships with key suppliers and focusing on local production of critical components like semiconductors, GM is mitigating risks and ensuring a steady supply of parts. Strengthening its supply chain can boost efficiency and profitability, further enhancing GM’s stock potential.

Comparative Analysis with Competitors

Here are the top 5 comparative analyses with competitors.

1. Market Positioning

When comparing competitors, market positioning is crucial. It’s all about how a brand differentiates itself in a crowded marketplace. For example, one competitor may focus on premium pricing, offering exclusive features to a niche audience, while another aims for affordability and mass-market appeal. Positioning influences consumer perception and loyalty. Knowing where a company stands allows you to better understand its strengths and how it appeals to specific customer segments, ensuring long-term success.

2. Strategic Advantages

Strategic advantages are what set a company apart from its competitors. For instance, some companies may benefit from superior technology, while others might rely on strong brand loyalty or innovative products. These advantages allow businesses to compete more effectively, maintain profitability, and dominate specific market segments. Understanding strategic advantages helps users make informed choices, knowing which company offers the most value for their needs.

3. Operational Efficiency

Operational efficiency is a key factor in competitive advantage. Companies that streamline processes, minimize waste, and reduce costs can offer products at a lower price or invest in innovation. For instance, Amazon’s logistics network allows for fast, cost-effective delivery. In contrast, less efficient competitors struggle with higher operating costs. Operational efficiency directly impacts a company’s ability to scale, maintain profitability, and improve customer experience.

4. Customer Satisfaction

Customer satisfaction is often the deciding factor in a brand’s success. Companies with strong customer service and reliable products or services tend to build long-term relationships with consumers. For example, Apple has loyal customers thanks to its seamless user experience. On the other hand, brands with poor customer feedback often struggle with retention. Satisfied customers are likely to recommend the brand, making this a vital area of comparison.

5. Innovation Capabilities

Innovation drives growth, setting leaders apart from followers. Companies that invest in research and development (R&D) often introduce groundbreaking products or services that shift market dynamics. For example, Tesla’s focus on electric vehicle innovation reshaped the automotive industry. In contrast, companies with limited innovation capabilities may fall behind, losing market share. The ability to adapt and create new solutions is essential for long-term competitive advantage.

GM’s Sustainability Initiatives and Impact on Stock

Here are the 5 GM’s sustainability initiatives.

1. Social Responsibility

General Motors (GM) is committed to social responsibility through various community-focused programs and partnerships. They invest in education, support for veterans, and economic development. For instance, GM’s “GM Foundation” donated $48 million to community causes in 2023. This commitment not only enhances their corporate image but can positively influence their stock by attracting socially-conscious investors.

2. Environmental Stewardship

GM is pushing towards a greener future with a target to become carbon neutral by 2040. They’ve committed $35 billion to electric and autonomous vehicles by 2025. This includes the development of new electric models and improvements in manufacturing processes. Such proactive measures enhance GM’s reputation and can bolster investor confidence, potentially boosting their stock value.

3. Governance Practices

GM follows robust governance practices to ensure transparency and accountability. Their board of directors oversees adherence to ethical standards and regulatory compliance. In 2023, GM was recognized for its governance framework, which includes regular audits and risk management processes. Strong governance can reassure investors about the company’s stability and long-term prospects, positively affecting their stock.

4. Innovation and Technology

GM invests heavily in innovation, focusing on autonomous driving technology and advanced infotainment systems. Their “Cruise” division, which specializes in self-driving technology, received $2 billion in funding in 2023. By leading in cutting-edge technology, GM positions itself as a forward-thinking company, which can attract tech-savvy investors and potentially drive stock performance.

5. Employee Engagement

GM places high importance on employee engagement and development. They offer various programs for career growth, including skill development workshops and leadership training. In 2023, GM was recognized as one of the best places to work in the automotive industry. A motivated and well-trained workforce contributes to operational efficiency and can positively impact GM’s stock by enhancing overall company performance.

Future Outlook for GM Stock

Here are the 5 future outlook for GM Stock.

1. Risk Mitigation:

General Motors (GM) is focusing on reducing risks by diversifying its portfolio and investing in electric vehicles (EVs). With their commitment to EVs and autonomous driving technologies, GM aims to lessen its dependence on traditional combustion engine vehicles, which could buffer against market volatility and regulatory changes affecting the auto industry.

2. Growth Prospects:

GM’s future growth looks promising with its aggressive push into EVs and autonomous vehicles. The company plans to launch several new electric models and expand its battery production capabilities. These initiatives position GM well to capture a larger share of the growing EV market, driving potential stock appreciation.

3. Strategic Adaptability:

GM’s strategy involves adapting to changing market conditions by embracing new technologies and business models. Their investments in ride-sharing and autonomous driving reflect a proactive approach to future transportation trends, allowing them to stay relevant and competitive in an evolving industry landscape.

4. Global Expansion:

GM is also focusing on expanding its presence in emerging markets. By increasing its footprint in regions like Asia and Latin America, GM aims to tap into new customer bases and leverage growth opportunities in rapidly developing economies.

5. Financial Health:

Evaluating GM’s financial health is crucial. The company has been working on improving its balance sheet by reducing debt and increasing cash flow. A strong financial position will enable GM to invest in innovation and weather economic downturns, positively impacting its stock performance.

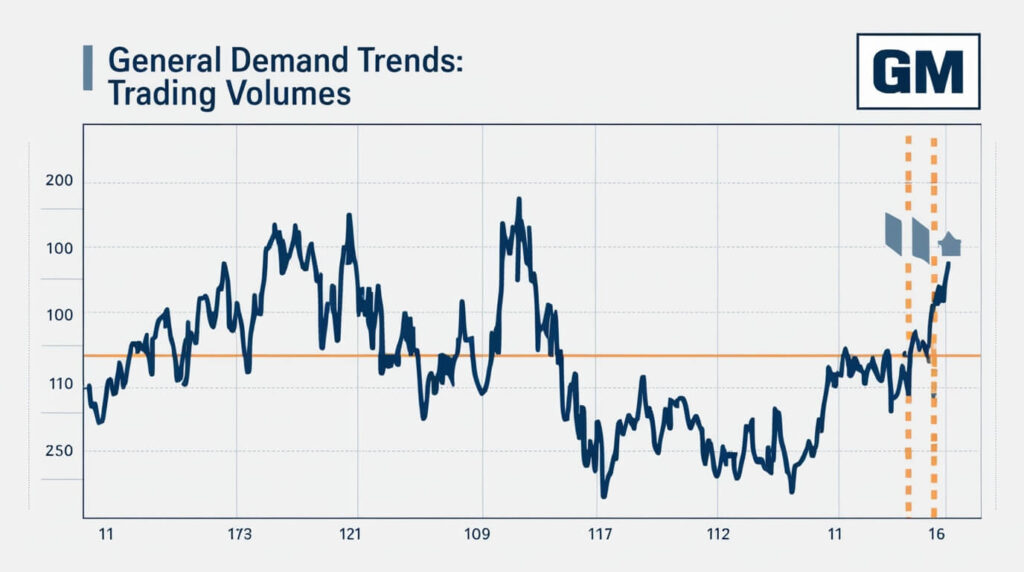

Market Demand Trends for FintechZoom GM Stock

Here are the top 4 market demand trends FintechZoom stocks.

1. Shift Towards Electric Vehicles (EVs):

As consumers increasingly prioritize sustainability, GM’s focus on electric vehicles aligns with market demand. The growing preference for eco-friendly transportation solutions enhances GM’s appeal. By expanding its EV lineup, GM is well-positioned to capitalize on this trend, potentially boosting stock performance and market share.

2. Rising Interest in Autonomous Driving:

The demand for autonomous driving technology is on the rise. GM’s investment in self-driving cars through its Cruise division positions it favorably. As consumers seek safer and more convenient driving options, GM’s advancements in autonomous vehicles could attract interest and drive stock growth.

3. Preference for Smart Technology Integration:

Modern consumers are drawn to vehicles with advanced tech features. GM’s integration of smart technology, such as enhanced infotainment systems and connectivity options, meets this demand. By offering innovative tech solutions, GM can attract tech-savvy buyers, boosting its market position and stock value.

4. Growing Market for Sustainable Transportation:

With increasing awareness of climate change, there’s a growing demand for sustainable transportation. GM’s commitment to reducing carbon emissions and investing in green technologies aligns with this trend. Meeting consumer demand for sustainable options can enhance GM’s reputation and drive stock appreciation.

Technological Advancements FintechZoom

General Motors (GM) is at the forefront of automotive technology, investing heavily in electric and autonomous vehicles. The company’s focus on developing advanced battery technologies and autonomous driving systems is key to its future success. GM’s Cruise division is pioneering self-driving technology, aiming to revolutionize transportation.

Additionally, their Ultium battery platform promises improved performance and cost efficiency for electric vehicles. These innovations are expected to enhance GM’s competitive edge, attract tech-savvy investors, and drive long-term stock growth. By staying ahead in technology, GM positions itself as a leader in the evolving automotive industry.

Conclusion

General Motors’ stock presents a compelling opportunity for investors interested in the automotive sector. With its strong historical performance and ambitious future plans, GM is well-positioned for growth. If you’re considering investing, keep an eye on the company’s EV strategy and overall market trends. For personalized investment advice, consult a financial advisor today.

FAQs

What is the current price of GM stock?

As of September 2024, GM’s stock is priced around $34 per share.

How does GM’s dividend yield compare to other stocks?

GM’s dividend yield is approximately 4%, higher than many industry peers.

What are the key factors driving GM’s stock price?

Key factors include GM’s investment in electric vehicles, overall financial health, and global economic conditions.